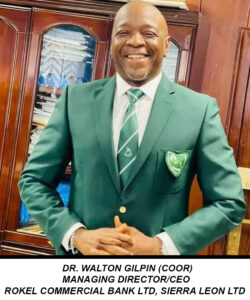

Amb. Dr. Ekundayo Walton Gilpin (COOR) is the Managing Director and CEO of Rokel Commercial Bank (SL) Ltd., a leading Commercial Bank in Sierra Leone. He is a seasoned and internationally recognised financial expert with over 30 years of experience managing complex policies and processes in banking and banking-related institutions in Africa, Europe, the South Pacific, the Caribbean, and the United States. Previously, he was an advisor to the Commonwealth Secretariat in the United Kingdom; where he managed significant financial and debt restructuring initiatives that formed the basis of effective and sustainable reform strategies in more than 25 countries. In his capacity, he has helped strengthen the technical and management capacity of financial sector professionals by emphasizing approaches and skill sets that bode well for institutional transformation and enduring change.

His goal-oriented professional philosophy has been a hallmark of his career. During his career, he has provided technical input into complex interactions with international partners, such as the International Monetary Fund and World Bank, and was instrumental in financial research analysis having worked in Research and International Financial Departments of reputable institutions. His capacity-building skills are significantly useful in designing and implementing training modules in financial analysis for public sector officials in government and central banking-related institutions. He was an economist and senior analyst at the Central Bank of Sierra Leone, where he rose to the position of Section Head within 4 years of service. In private practice, Dr. Gilpin has served as a consultant in public finance, risk management, liquidity management, and bank-sovereign interdependence and has also worked on projects for reputable organizations such as the International Monetary Fund, World Bank, African Development Bank, and the United Nations Development Program.

Dr. Gilpin is also taking a leadership role in enhancing financial literacy through public lectures at Universities, colleges, and other institutions of learning in Sierra Leone. This has been part of his strategy to implement the content of the Sierra Leone National Strategy for Financial Inclusion (NSFI) since 2019 to date, and this document is considered to be a key policy document from the Banking and Financial Regulator in Sierra Leone (Bank of Sierra Leone).

Currently, despite his busy schedule, Ambassador Gilpin normally shows up intermittently for TV programs known as the “The Economic Forum” to educate Sierra Leoneans on the financial industry, Businesses and the banking sector on a voluntary basis. The Managing Director believes that one of the functions of bankers is not to sit in the air conditions, with coat and tie but to help the smaller businesses grow with economy.

In a very competitive environment, Dr. Gilpin introduced “The Rokel Sim Korpor Plus App” under his current reign which is bringing greater financial inclusion and convenience to participants in Sierra Leone’s economy. The App is a game changer that revolutionizes Banking in Sierra Leone.

With his leadership skills and the help of his dedicated staff, Rokel Bank has become one of the most profitable financial institutions in the country.

In 2022, under his leadership, Rokel Bank provided finances in the form of loans to Krootown Road Market Women In a bid to empower women who engage in Micro, Small, and Medium enterprises (MSMEs). All this is geared toward the implementation of the Mid-Term National Development Plan of Sierra Leone and the Sierra Leone National Strategy for Financial Inclusion.

According to the Bank’s Published financial statements, they recorded a profit (before tax) that represents a 6.1% increase in 2021 when compared to the prior year, and a similar trend has been seen for the year 2022 with a seeming good year performance for 2023.

In May 2023, Dr. Gilpin was listed among the 25 Top Financial Leaders in Africa for 2023 by The African Leadership Magazine (ALM) UK.